Earning Income Tax Credit Table - One of the best ways to reduce tax burden for those in low-income groups is through the Earned Income Tax Credit (EITC) program. It is a federal program that provides tax credits to working individuals and families with low to moderate income. In the United States, there is a significant number of Asian Americans who are eligible for this tax credit. However, a large number of eligible individuals do not take advantage of this program, which often leads to lost eligibility and thousands of dollars in unclaimed credit. To help our Asian American community, we have compiled some tips and ideas on how to maximize the benefits of the EITC program.

What is EITC?

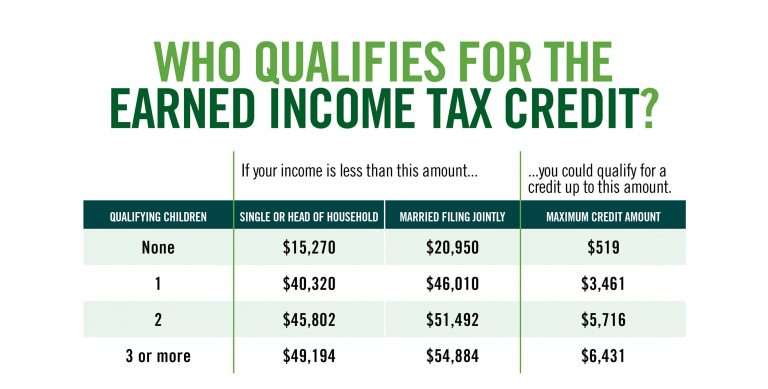

EITC is a refundable tax credit that gives working individuals and families, who meet certain eligibility requirements, a monetary credit. The amount of the credit is based on the amount a person earns during a tax year, as well as the number of qualifying dependents listed on their tax return. This credit can be worth up to thousands of dollars depending on individual or family earnings.

Who is eligible?

Generally, individuals or families who have earned income below a certain level will qualify for this credit. The specific thresholds depend on filing status and number of qualifying children, but for the 2020 tax year, the maximum adjusted gross income (AGI) for a single filer with no children was $15,820. For a married couple filing jointly with three or more children, the maximum AGI was $57,330.

How to apply?

If you're eligible for EITC, you need to file a tax return, even if you did not earn enough income to be obligated to file. It's important to note that EITC is not automatically given, and you need to claim it on your tax return. You can file your tax return electronically through tax preparation software, hire a tax professional to file on your behalf, or file a paper return. Note that certain low-income individuals may be eligible for free tax preparation services through the IRS's Volunteer Income Tax Assistance (VITA) program.

What documents do you need?

When applying for EITC, you will need to provide the following documents:

- Social Security number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children listed on your tax return

- Earned Income Statements (W2s or 1099 forms) for the tax year you are filing

- Any additional tax documents such as unemployment compensation or interest earned from savings accounts

How to maximize your credit?

Below are some tips and ideas on how to maximize your credit and get the most financial benefit:

Claim all eligible dependents

While your eligibility for EITC is determined based on your income, the amount of credit you receive is determined by the number of eligible dependents. Make sure to claim all eligible dependents on your tax return, including children, parents, and other relatives who meet the eligibility requirements.

File as head of household if applicable

If you're a single parent or live with a qualifying relative, you may be able to file as "head of household," which often results in a larger credit than filing as a single taxpayer.

Consider contributing to a retirement account

If you have taxable income, contributing to a retirement account such as an IRA or 401(k) can help you lower your tax liability, which can increase your eligibility for EITC.

Use free tax preparation services

If you're on a tight budget, consider using free tax preparation services such as the IRS's VITA program. These services offer free tax preparation and filing services for eligible individuals and families, which can save you hundreds of dollars in tax preparation fees.

Plan ahead for next year

If you're eligible for EITC this year, plan ahead for next year by adjusting your tax withholding exemptions and increasing your retirement contributions. Doing so can help you lower your taxable income and increase your eligibility for EITC.

Don't lose your eligibility

Remember that eligibility for EITC is based on your income for the year, so if your income increases the following year, you may no longer be eligible for the credit. Make sure to file your taxes every year to maintain your eligibility for EITC.

Conclusion

Maximizing the benefits of the EITC program is a great way for Asian Americans to reduce their tax burden and get more financial benefits, especially for those in low-income groups. By being aware of eligibility requirements and taking advantage of tips and ideas to maximize the credit, you can potentially receive thousands of dollars for your family's financial future. Remember, it's important to file your tax return every year to maintain your eligibility for the credit.

Find more articles about Earning Income Tax Credit Table