Present Value Table Of Annuity - is a fundamental tool for measuring the worth of a prospective investment or stream of payouts. It is a financial calculation that determines the current value of a series of future payments, assuming a steady rate of return over a set length of time. In this post, we will explore the different present value annuity tables that exist, how they are used, and some helpful tips for incorporating them into your financial planning.

Present Value Annuity Tables

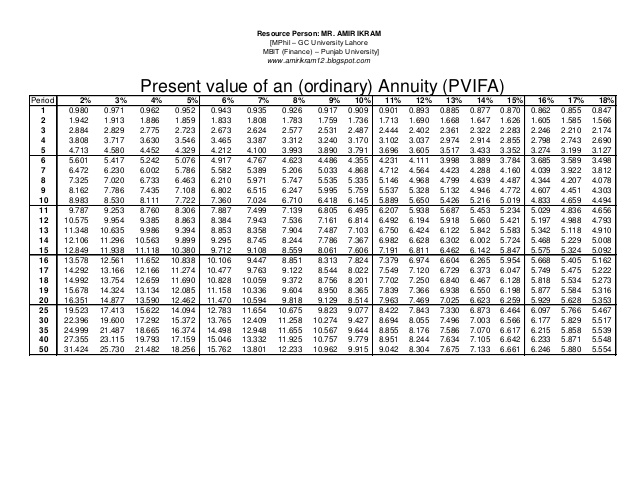

Table 1: Present Value of $1 Annuity

This table shows the present value of $1 paid out annually for a specified number of years, at a given interest rate. For instance, if you were to invest $1,000 per year for 10 years, with a 5% interest rate, the present value of that investment after year one would be $952.38, and after year ten would be $7,722.76, assuming that the rate of return remains constant throughout that time.

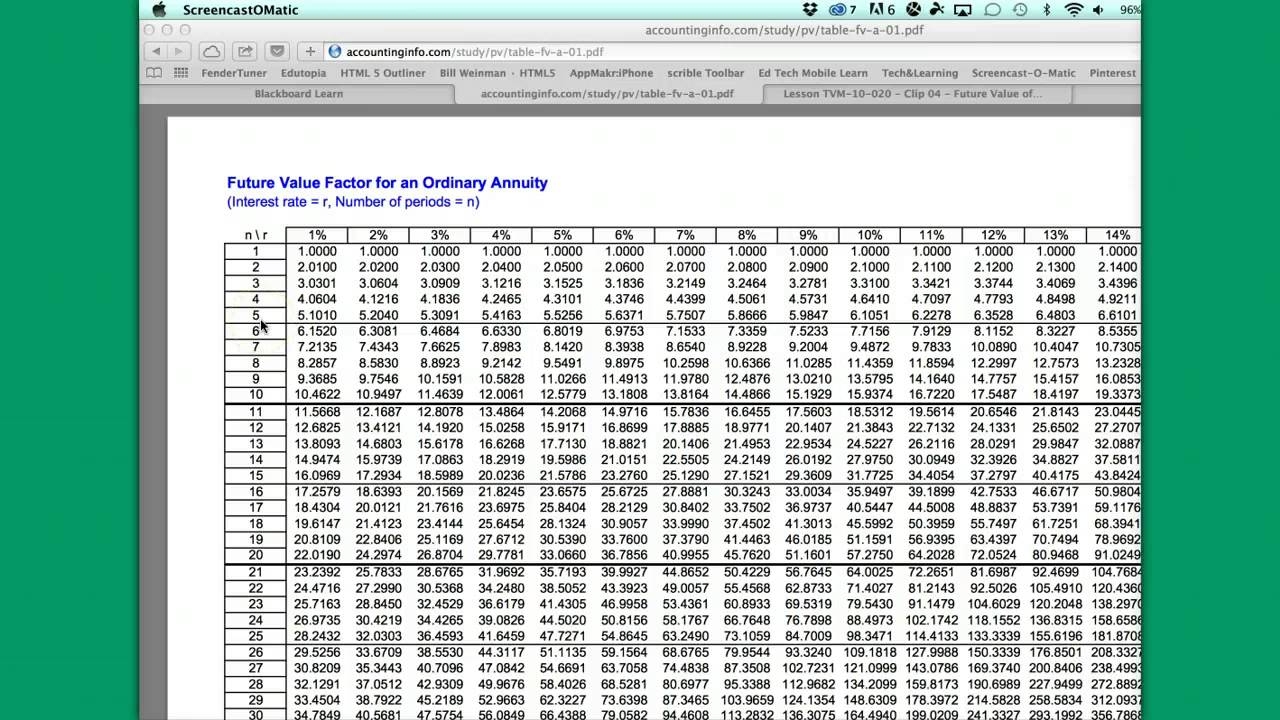

Table 2: Future Value of Annuity Due

This table illustrates the future value of payments made at the beginning of each period, as opposed to at the end. To arrive at a future value, you simply add interest to the initial investment, year by year, until you reach the end of the period in question.

Table 3: Present Value of Annuity Due

This table is the most widely used of the group, as it shows the present value of a series of payments made at the beginning of each period, at a set interest rate. For example, if you receive $5,000 a year for five years, beginning immediately, and the interest rate is 3%, the present value of that payment stream is $22,789.91.

Tips for Using Present Value Annuity Tables

Start with a Clear Objective

Before you begin making calculations with these tables, be sure you have a clear understanding of your financial objective. What are you hoping to gain from your investment? Are you trying to save for retirement, establish an emergency fund, or pay off student loans? Once you have a specific goal in mind, it will be easier to determine the appropriate rate of return and the length of time over which to make your investment.

Factor in Inflation

When making calculations with these tables, it is important to consider the impact of inflation on your investment. Inflation erodes the value of money over time, which means that you will need to earn a higher rate of return in order to achieve your desired outcome.

Consider Tax Implications

Depending on the type of investment you are making, there may be tax implications to consider. Be sure to factor these into your calculations, as they can significantly impact the overall value of your investment.

Consult a Financial Advisor

While present value annuity tables can be extremely helpful in making investment decisions, it is always wise to consult a financial advisor before making any major financial decisions. An advisor can help you evaluate your options, weigh the pros and cons of various investment strategies, and develop a customized investment plan that aligns with your specific goals and risk tolerance.

In conclusion, Present Value Table Of Annuity is a useful tool that can help you better understand the present and future value of your investments. By using these tables and following some basic tips, you can make informed financial decisions that will help you achieve your long-term goals.

Find more articles about Present Value Table Of Annuity